Also essential to note, automobile insurance coverage costs are separate from your deductible, which is the buck amount you have to pay prior to your insurance policy will kick in. All sorts of insurance coverage need you to pay a costs, not simply car: home owners, life and also renters insurance policy likewise need exceptional payments. Exactly How are Automobile Insurance Policy Premiums Determined? Insurer think about several variables when establishing cars and truck insurance policy premiums.

As an example, a 16-year-old boy in a brand-new cars will pay a lot higher insurance premiums than a 40-year-old lady in a station wagon. This is because the young boy is extra most likely to be in a mishap, as well as his automobile will certainly be much more pricey to fix if he enters one.

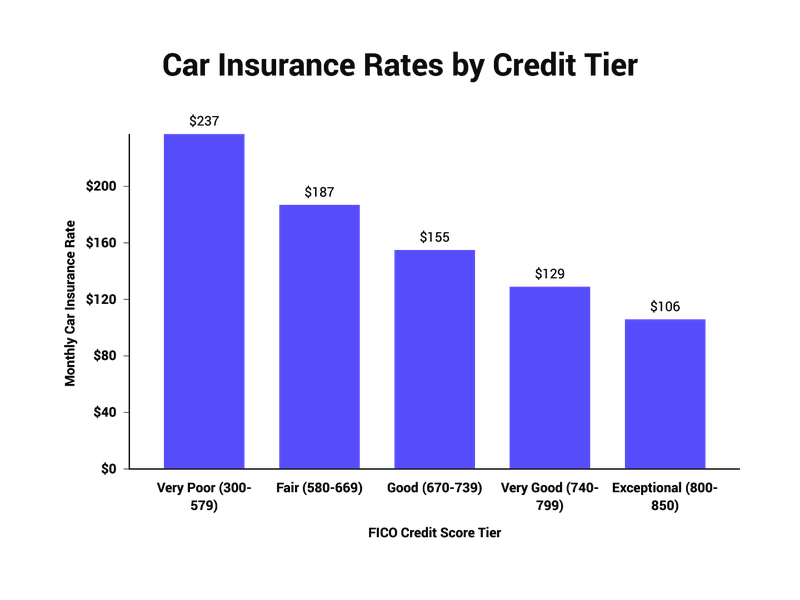

Right here are some details your insurer might consider when establishing your premium.: Your age, sex as well as where you live.: The more accountable you have been in the past with your money as well as behind the wheel, the reduced your premium (insurance company).: Newer, faster and also a lot more costly automobiles have greater premiums across the board.

No problem. No surprise expenses. Decreasing Your Insurance Costs Of training course, a few of these aspects are more challenging to transform than others, and some can not be changed at all. It's not practical to transfer to a various city or alter your age simply to conserve money on cars and truck insurance coverage. But you can normally customize your insurance plan to fit your needs as well as your budget, so long as you remain within the insurance policy demands in your state.

It is necessary to have a great understanding of to make sure that you only pay for protections you need (car). Inevitably, every insurance provider considers variables differently, so to see that will give you the best rates.: The Distinction In Between a Quote as well as a Premium When you get an insurance quote from an insurance policy business, that's an estimate of just how much the firm will certainly charge you for insurance.

Numerous insurer will certainly let you pick exactly how often you wish to payand you'll Click here for more info normally get a "paid in full" price cut when you pay pay more upfront - cheaper car insurance.: However, in many cases, you might be required to pay your entire term upfront. This is specifically usual if you're regarded an at-risk driverfor example, if you formerly allow your insurance policy gap or you require an.

What's The Average Cost Of Car Insurance In 2020? - Business ... Things To Know Before You Get This

When Do Auto Insurance Policy Premiums Increase? Automobile insurance is normally sold in either six- or 12-month terms. However long your term is, your insurance policy prices will remain the very same for that term unless you make a change to your policy, such as if you purchase a brand-new automobile or move to a brand-new residence.

If you were associated with a mishap or were caught speeding, your rates could increase; conversely, if you took a safe driving course, your price could drop - suvs. Insurance firms are additionally frequently changing their models for just how much to charge for insurance, so it's feasible your rate will certainly fluctuate without any kind of changes in your driving condition whatsoever.

If you're brand-new to the world of car insurance, you may be asking yourself: What are cars and truck insurance policy costs? Your costs is what you pay your insurance provider for automobile insurance policy each coverage duration. insurers. In this write-up, we at the Residence Media evaluates team will look at what automobile insurance policy premiums are, exactly how they're determined, ways to reduce your settlements as well as even more.

Car insurance policy premium introduction An auto insurance policy premium is one more word for your cars and truck insurance costs. It is the quantity you have to pay to maintain your automobile insurance coverage valid.

Auto insurance quote vs. premium A car insurance policy quote is not the same point as a premium. You might get to out to numerous firms as well as get various costs for car insurance policy. cheap car.

This is due to the fact that insurance policy business obtain even more info that can influence your price when you start the policy. The rate could transform if you really did not enter your cars and truck's VIN right into the quote kind or if you really did not include all household chauffeurs at that time - risks. Or, your rate could alter if the firm utilizes a credit-based insurance coverage score to calculate threat after you got the quote.

Not known Details About What Is A Car Insurance Premium? - 2022 Guide - Policygenius

auto insurance car insured cheap auto insurance insurance companies

auto insurance car insured cheap auto insurance insurance companies

Your costs contribute to a regional insurance policy pool that is impacted by state policies and also total claims (insurance). On the other hand, if your state introduces brand-new legislation to control insurance coverage prices, you might see a lower price in your next policy duration.

There is no standard vehicle insurance premium for each vehicle driver. These costs are extremely customized, and also each insurance firm calculates automobile insurance coverage premiums differently. The majority of think about the adhering to when establishing rates: What does a vehicle insurance policy premium price? Our group assessed full coverage rate price quotes for 35-year-old motorists with good credit rating and driving records from a range of cars and truck insurer.

Take a motorist safety training course: Numerous insurance firms supply discounts for completing a state-approved motorist safety program. Choose usage-based insurance coverage, if it might profit you: Numerous insurers supply usage-based discount rate programs (risks).

low cost suvs affordable car insurance dui

low cost suvs affordable car insurance dui

Our method Due to the fact that customers count on us to supply objective and precise info, we created a thorough ranking system to develop our rankings of the most effective auto insurance provider. We collected data on loads of vehicle insurance coverage suppliers to quality the companies on a wide variety of ranking factors. Completion result was an overall ranking for each service provider, with the insurance providers that scored one of the most factors topping the listing (cheaper car insurance).

Coverage (20% of total rating): Business that offer a range of choices for insurance policy coverage are more probable to satisfy consumer demands - cheaper car. Reputation (20% of complete score): Our study group considered market share, ratings from industry specialists as well as years in service when giving this score. Schedule (20% of total score): Auto insurance provider with greater state schedule and also couple of eligibility demands racked up greatest in this group.

The cash we make helps us provide you accessibility to complimentary credit history as well as reports and also assists us develop our various other wonderful tools as well as academic materials. Payment might factor right into just how and where products appear on our system (and in what order). Yet since we normally make money when you discover a deal you such as and also get, we try to show you uses we believe are an excellent match for you.

The 3-Minute Rule for Your Auto Insurance Premium Changes Based Upon ...

Naturally, the deals on our platform do not represent all financial products out there, but our objective is to reveal you as several terrific options as we can. The expense of your vehicle insurance policy costs may differ considering that it's based on a variety of various elements, including your driving record, just how much you drive, the kinds of insurance protection you pick and also even your age.

cheapest car cheap auto insurance low cost auto cheaper car insurance

cheapest car cheap auto insurance low cost auto cheaper car insurance

Your cars and truck insurance coverage costs may be paid monthly, every six months, or even just when a year, depending on the repayment choices your car insurance policy business offers. In exchange for your auto insurance coverage premium, your insurance coverage service provider will certainly offer you with the insurance coverage detailed in your insurance coverage policy.

In every state except New Hampshire, you're required to have a minimum amount of protection. car insured. This can assist shield your wallet by covering expenses up to the insurance coverage limit detailed in the policy you choose for instance, to cover injuries or property damage you cause an additional driver in a crash.

The cost of your vehicle insurance costs can rely on a number of various variables some of which you can control (as an example, where you live or the kind of auto you drive) and also some that are out of your control (such as your age). Spend for insurance policy that thinks about exactly how you drive, not just that you are Below are some of the factors that can impact your vehicle insurance coverage rates.

And also picking high coverage limitations and/or low deductibles will likely drive up your cost of cars and truck insurance, too. Are you a knowledgeable chauffeur without any type of imperfections on your record? Or do you have a few tickets and a crash or more in your driving background? Even the quantity of time you have actually been driving can impact your insurance coverage premium.

More youthful drivers commonly pay much more for insurance policy protection since they have much less experience when traveling as well as go to greater threat of being associated with an accident. When determining your premium, insurer take into consideration a couple of variables associated with your automobile, such as the cost to repair it as well as overall safety document.

Our What Are Insurance Premiums? - The Balance Diaries

The higher the deductible, the lower the costs. With a $500 deductible, your premium expense would be much less, but you pay the very first $500 anytime you have a detailed insurance claim. insurance covers you for specifically that: crashes that damage your automobile. Once more, the greater the insurance deductible, the lower the costs.

e - cheap car. reliability for paying bills). Credit history is made use of by numerous insurer as a rating aspect for vehicle insurance. is the quantity you pay out of your very own pocket when you have a case. are specific scenarios under which your plan will not cover you or your car.

An automobile insurance coverage costs is the amount you agree to pay to the insurance provider in exchange for automobile insurance coverage. Automobile insurance premiums are based upon many elements, consisting of the sort of insurance coverage you choose, your age (except in Hawaii), driving history, the lorry's make, design and age as well as the insurer you pick.

What is a vehicle insurance coverage costs? You can pay it all at once or monthly, which might come with additional installment costs.

As long as you proceed paying the vehicle insurance premiums promptly, your insurer pledges to protect you as well as your car in case of an accident or other covered loss. When you quit paying the premium, the insurance provider can terminate your plan after a certain duration - cheapest car insurance.

When you are buying vehicle insurance policy, you might discover one more expense called a deductible. Your premium and also your deductible are 2 different costs. You are only called for to pay the insurance deductible when you file a covered case. An out-of-pocket charge will certainly be subtracted from the amount your insurance policy business pays to cover the claim.

10 Simple Techniques For Auto Insurance Premium Comparisons - Mass.gov

cheaper car insurance prices business insurance car insurance

cheaper car insurance prices business insurance car insurance

What alternatives do I have with my vehicle insurance coverage premium? You have several choices with your car insurance costs. You can pay it completely or in installments, typically regular monthly, quarterly or semi-annual, depending upon the size of the plan term. You generally get the very best offer on insurance coverage expenses when you pay completely and stay clear of installation as well as handling fees.

car insurance laws dui

car insurance laws dui

Each business has its very own set of discount rates provided, as well as lots of can be piled with each other for added savings. You can inspect with each insurance company to locate out which discount rates it offers.

There are a number of factors that service providers make use of to compute your distinct rate. Several of these factors you can control, and also others you can not. Below are several of things that impact your auto insurance policy premium: Your age and state, Exactly how old you are and also where you live are 2 of the greatest elements that influence your automobile insurance coverage premium.